Unilever has set itself the goal of making all its products completely biodegradable, knowing it would be a massive undertaking. By investing in research, working with its partners across its supply chain, and considering the entire product lifecycle, Unilever is making progress towards this clean future

Like most businesses, Unilever is looking at how it can improve the sustainability of its operations. One stated goal is to make all its products completely biodegradable, by 2030. ‘Most of our home care, beauty and personal care products eventually go down the drain,’ says Ian Malcomber, chemical safety and programme director in the company’s Safety and Environmental Assurance Centre (SEAC). ‘We want to make sure the Earth’s resources are not impacted by our products.’

While Unilever is already careful only to use ingredients with data that documents their safety both to humans and the environment, a couple of years ago there was a realisation that consumer sentiment was trending away from ingredients that remain longer in the environment after use, regardless of whether they do harm or not. Consumers want products to leave no trace.

The surfactants that are the major component of most household and personal care products have changed enormously in recent years, and are now routinely biodegradable. The branched surfactants introduced in the 1950s did not break down very quickly, forming foams in waterways and treatment plants, and biodegradable linear surfactant molecules were designed to replace them. ‘They are a good example of high-volume materials that were re-engineered to be able to biodegrade completely and quickly,’ says Chris Finnegan, safety and sustainability science leader at Unilever’s SEAC.

Volume-wise, more than 90% of the ingredients in Unilever’s products already biodegrade within hours, days or, at most, weeks. But the remainder can take longer to break down. This includes polymer materials with applications such as rheology modification or soil release. Other examples are silicones in hair conditioners, and fluorescers used as optical brightening agents in laundry detergents. All are used in much smaller volumes.

this leaves the dichotomy of how to make something that is designed to be stable into something more unstable. Innovation will be required to unpick the science of these materials

Ian Howell, homecare science and technology R&D director, Unilever

For laundry products, the biggest challenge is with the use of polymers and high-performance chemicals that are added to make concentrated products, which are more effective and lower the carbon footprint of the product. ‘They’ve done a great job because they allowed us to reduce our total chemical loading and that now enables us to shift our focus to ensure all ingredients are also fully biodegradable,’ says Ian Howell, homecare science and technology R&D director.

Polymers provide rheology modification to liquids, as thicker liquids (which consumers prefer) are easier to measure out and handle, but non-biodegradable polyacrylates predominate. Cleaning polymers are now routinely added to laundry detergents. These stabilise soils in the wash to give better performance, but although some advances have been made, many biodegrade slowly. But polymers are not the only challenge.

There is no known rapidly biodegradable alternative to the fluorescent optical brightening agents, Howell says. ‘The aromatic molecules are stable, which you want to prevent them photodegrading. This leaves the dichotomy of how to make something that is designed to be stable into something more unstable. Innovation will be required to unpick the science of these materials.’

there is an exciting world ahead for future students to get involved in

Chris Finnegan, safety and sustainability science leader, Unilever

Some fragrance ingredients and pH-stable colorants can also biodegrade slowly. Fragrances in fabric conditioners can be encapsulated in polymers that are slowly biodegradable. This encapsulation has allowed the amount of fragrance in a product to be reduced, which is good from a sustainability standpoint, but less so for biodegradability.

New molecules and formulations

Unilever makes very few of the ingredients it uses; the vast majority are sourced from chemicals manufacturers and suppliers. ‘We are working in partnership with our suppliers to see if there are existing chemistries that might be able to meet the need, or whether new ones will be needed,’ Malcomber says. ‘How can we partner with them to help them commercialise these technologies?’

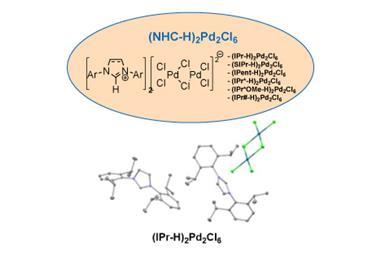

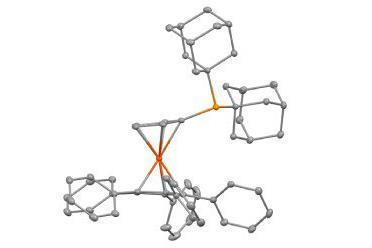

It may be possible to rationally design biodegradable alternatives, highlighting the importance of building up science and capabilities in biodegradation science. ‘A lot of knowledge has been built up in the design of molecules, such as whether inserting a group, or orientating it differently, might give access points for bacteria to break it down quickly,’ Finnegan says. ‘There is an exciting world ahead for future students to get involved in.’

This will require broader collaboration with academia and industrial partners. . To that end Unilever is partnering with the Universities of Liverpool and Oxford on an £8.8m program supported by the EPSRC. ’We will not achieve the UK’s Net Zero goal by 2050 without a transformation of the global chemical supply chain,’ says Howell. ’This partnership is an important milestone towards that transformation by galvanising research on new renewable and biodegradable materials for everyday products, such as detergents.’

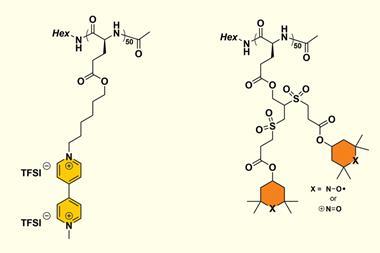

‘One might take a biodegradable natural polymer but then need to functionalise it for a specific application, but there aren’t that many natural polymers, and the modifications may prevent biodegradation,’ Howell continues. ‘This is why we want to use renewable monomers to make functional polymers, building in biodegradable links.’

the big elephant in the room is how do you make a biodegradable product that is both hydrolytically and enzymatically stable, when biodegradation is all about enzymatic and hydrolytic instability

Ian Howell

Achieving full biodegradability isn’t simply a case of finding new ingredients: the formulation challenges are also significant. In contrast to the renewables programme, where LAB surfactants from renewable and petrochemical sources have the same molecular structure and therefore can be switched in without problems, drop-in biodegradable replacements are unlikely as the new molecular structure will interact differently with all the other ingredients. ‘The whole system has been designed to enable cleaning polymers to work,’ Howell says. ‘Tweaks to the formulation are likely to be required – it might need a different surfactant ratio, perhaps, or a slightly different ionic strength. And some of the other ingredients might also need to be changed. It is a huge optimisation challenge.’

While there is a desire to use only ingredients that biodegrade fairly quickly, there is a balance – the product also has to be shelf-stable. Take the enzymes that break down dirt and stains in laundry liquids. Esterases chew up oily and fatty stains, which are often esters, but if polymers are made biodegradable by inserting ester links, the enzymes might destroy them, too. ‘The big elephant in the room is how do you make a biodegradable product that is both hydrolytically and enzymatically stable, when biodegradation is all about enzymatic and hydrolytic instability?’ Howell says. ‘Do I need to invent a new format that segregates materials so my biodegradable polymer doesn’t come into contact with the enzymes until they meet in the wash? It might be the only way to have a stable product that is also biodegradable.’

And then there’s acrylic-maleic copolymer used in powder formulations to prevent aggregation during processing and storage, keeping them as powders. While in Europe liquid laundry detergents are now commonplace, in many developing markets powders still dominate, partly for affordability for many consumers, and partly because of their effective cleaning. 58% of the company’s turnover in 2020 was in emerging markets, and more costly replacements are unlikely to be acceptable. ‘We have still got to be able to cater to those consumers, too,’ Malcomber says.

It is important we get the messages right for chemicals, and we need to have robust data

Chris Finnegan

One early success story has already come in the Persil brand. Unilever has been working with a supplier to introduce biodegradable features into the soil release polymer molecules, as well as changing to green carbon sourcing.

Prove it!

Consumers will need reassurance that the products are, indeed, biodegradable. ‘Biodegradation for chemicals has been overshadowed by some of the “greenwash” around biodegradable packaging,’ Finnegan says. ‘It is important we get the messages right for chemicals, and we need to have robust data.’

There are already OECD-approved methodologies for assessing biodegradability. Ultimate biodegradation means it breaks down completely to its component parts – carbon dioxide, water and mineral salts – which get returned to the Earth’s natural cycles.

But even if something does undergo ultimate biodegradation, the rate at which it breaks down is important. OECD test guidelines cover both how readily a chemical biodegrades, and whether it biodegrades completely. ‘Ready biodegradation is accepted to translate to biodegradation in the environment in hours or days, while for the inherent test, it could be hours, days or weeks – but not months or years,’ Malcomber says. ‘This is where consumer concern could arise if things are staying in the environment for an excessively long period of time.’

Much of the biodegradation data is generated by the ingredient suppliers but, Finnegan says, the tests are not perfect for every chemical class: they tend to be better suited to water-soluble materials. ‘Task forces are coming together to evolve more suitable tests for materials with challenging physicochemical profiles,’ he says. ‘There is a lot of interest in whether tests can be further evolved to take in broader chemistries.’

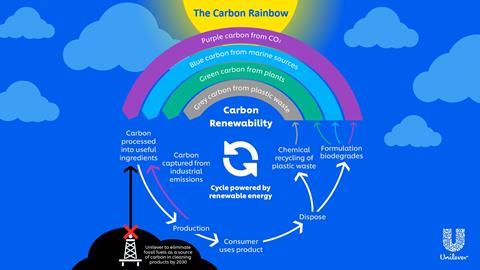

There is also the prospect of adding renewable sources into the mix, too; Unilever’s Carbon Rainbow programme outlines the approach to diversify sources of carbon. ‘If you can identify chemistry that is biodegradable, could we create it from carbon that is not sourced from petrochemicals, but from carbon capture or plant-based sources?’ Malcomber says.

‘It shouldn’t necessarily make it more difficult – we just have to make sure we account for biodegradability as we are developing those renewable sources. This is how our commitments combine – by also moving to renewable materials, the CO2 is not from fossil fuels, so it doesn’t release petrochemical-derived carbon.’

But the 2030 target for full biodegradability remains challenging, Howell says. ‘With the brand team over the next year or so we will be looking through the challenging list of slowly biodegradable materials we use, and deciding which we will have to drop, which have an acceptable alternative, and where we need a research breakthrough. It’s a massive undertaking.’

Unilever’s ambitions are big, so we are always on the lookout for partners who can offer fresh expertise or disruptive technology to help us make the ground-breaking change. Connect with us through our Open Innovation portal

Additional information

By investing in research, working with its partners across its supply chain, and considering the entire product lifecycle, Unilever is making progress towards this clean future.

No comments yet