Fermentation can improve sustainability at competitive costs

In the quest for increased sustainability, a lot has been made of the potential to use bio-based raw materials, captured CO2 and recycled plastics as raw materials for new chemicals. But what about using biotech processes to manufacture chemicals? Could it offer a more sustainable alternative to traditional petrochemical processing, and be more amenable to biobased raw materials?

It’s something companies both large and small are investigating. Covestro, for example, has a pilot plant at its headquarters site in Leverkusen, Germany, making aniline from biomass via a fermentation process. This basic chemical is typically manufactured from naphtha; the fermentation requires much milder conditions, and the intermediate isolated from the fermentation is then transformed to aniline via a catalytic reaction.

BASF, meanwhile, has been working on industrial biotechnology for more than three decades, first for the animal feed enzyme phytase, and then shifting vitamin B2 production from a chemical to a biotech process more than 20 years ago. ‘Since then, many products have been commercialised in various application fields,’ says Eva Wilke, vice president for white biotechnology research. Examples, she says, include a new insecticide, Inscalis, where a combination of fermentation and selective chemical synthesis gives a cost-effective process. There are also enzyme products for detergents and animal feed, and natural flavours and fragrances made by subsidiary Isobionics.

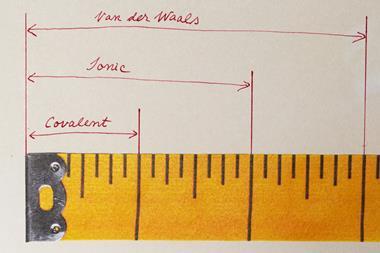

Its largest-scale process uses an enzymatic conversion to make acrylamide; the company’s Nanjing, China facility has a capacity of more than 50kT/year. ‘The benefits of the enzymatically catalysed process were significant, because of the high activity of the biocatalyst,’ she says. ‘Catalyst costs went down, the biocatalytic process runs at ambient pressure and lower temperature, reducing the energy costs, capital expenditures are reduced compared to the Cu-catalyst based conventional process, and it uses lower grade raw materials.’

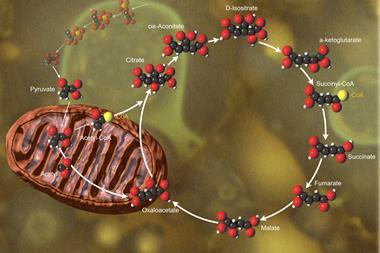

Taking a biotechnology approach also allows a much wider range of starting materials to be tapped into. ‘Nature was very inventive in utilising various energy and carbon sources,’ Wilke says. ‘Together with the enormous development in synthetic biology in the past two decades, it is now possible to rewire the cellular metabolism to use unconventional raw material streams to produce interesting chemical intermediates or performance molecules.’

Generally, she says, products are made by fungal or microbial fermentation processes, with renewable raw materials like sugars and vegetable oil that are rarely suitable for traditional chemical processes. ‘The development time depends strongly on the path to commercialisation,’ she says. ‘If a new production plant needs to be built, it can be six to 10 years, while for a new product that fits into an existing asset or can be manufactured at a contract manufacturing organisation (CMO), typical development times are three to five years.’

It is now possible to rewire the cellular metabolism to use unconventional raw material streams to produce interesting molecules

Outsourcing to a CMO in the early stages is vital for start-ups looking to make chemical products via fermentation, as they are unlikely to have the resources to build their own production capacity before they have proved viability. It allows the concept to be proved before the cash is spent. One such CMO is Columbus, Georgia-based Fermworx, which was initially making dextran polysaccharide biopolymers, but competing on price proved difficult and it pivoted to CMO work.

‘In the US, fermentation capacity is pretty limited, and a lot of people go to India, China or Europe where there is a fair amount of capacity,’ Fermworx chief executive Jon Getzinger says. ‘There is a move afoot to onshore products back to the US, with the Department of Defense helping lead that charge, and we work on several projects here with them.’ Soaring interest rates in 2023 led to a lot of start-up funding drying up, but there is now a robust rebound, he says, and both the pilot lab and pilot plant are booked up for several months.

Getzinger does not believe sustainability alone is sufficient to build a large-scale business. ‘At some point, it’s going to come up against a lot of competition from other sources, if it’s not already,’ he says. ‘You’d better have a plan to get to the point where you’re competitive with legacy chemical production.’

He says he is already seeing companies with products that should be competitive when they’re at scale, but part of the problem is that they can assume their processes will be easy to scale up. ‘Fermentation is as much art as science, and the idea that you can just build fermentation capacity, plug in a process and it will all work – it’s truly not that way. It’s the same with anything you grow, whether it’s an agricultural crop or a fermentation. There will always be some failures.’

And, of course, if a batch fails there is no recovery. ‘In one recent run, the next batch – a different product – was contaminated,’ he says. The problem turned out to be a particularly resilient organism from the previous run. ‘It now requires a much more aggressive cleaning schedule, which costs time, money and can put wear and tear on your equipment.’

He is certain that it’s possible for fermentation production to be cost-competitive for certain chemicals, particularly with tailored organisms. ‘Will they do it with all chemicals?’ he says. ‘I don’t think so. Oil is still pretty cheap, and you can do a lot with it, especially with processes that have been ironed out over decades.’ He cites a superabsorbent polymer they are currently working on, saying it will likely be less expensive than the conventional alternatives once it’s at scale.

Getzinger believes fermentation has a bright future. ‘The biggest problem in our industry now in the US is that a lot of people want the capacity,’ he says. ‘Companies in Silicon Valley or Boston are creating great organisms, but nobody thinks it’s sexy to put the steel in the ground. Our goal is to get to the scale where we all make money at it.’

Michele Stansfield, co-founder and chief executive at Australia-based Cauldron Ferm, believes the fact that biomanufacturing can be optimised for a wide range of resource-efficient products make it a promising alternative to petrochemical-based manufacturing. ‘A key advantage of using fermentation to produce chemicals is reducing the reliance on non-renewable fossil fuels,’ she says. ‘Fermentation also presents a safe, lower energy consumption alternative. Unlike many chemical manufacturing processes that require high heat or pressure, fermentation typically operates at lower temperatures and pressures. Biomanufacturing also allows for the manufacture of complex biomolecules such as proteins, which are not readily made by chemical synthesis processes.’

You need a plan to get to the point where you’re competitive with legacy chemical production

Lowering production costs to deliver bio-products at, or below, cost parity will be key to realising the industry’s full potential, she says. ‘Scaling production up to industrial levels presents another challenge, as this often requires significant investment in building new infrastructure. To gain momentum in high volume sectors like chemicals, it’s critical to design and build manufacturing capacity that can scale in a capital-efficient manner.’

Cauldron’s hyper-fermentation technology enables a continuous process, in contrast to a normal batch fermentation, where production is limited to the volume of the reactor. ‘The underlying hyper-fermentation technology solves historical continuous fermentation challenges around contamination and genetic drift, to sustain a healthy culture, optimised for cell vitality,’ she says. ‘Compared to fed-batch production, hyper-fermentation drives significant gains in productivity – producing more product at less cost.’

She says the process is well suited to bio-products in mainstream sectors where high production volumes are needed, but low cost of production and reasonable capital expenditure are critical to achieving viable economics. Away from chemicals, she believes it has potential in sectors such as food ingredients, cosmetics and personal care products, materials and even fuels.

The team has worked with client strains of a range of organisms, including yeast, filamentous fungi, heterotrophic algae, and E. coli bacteria. ‘We’ve demonstrated success cases with clients at 10,000 litre scale – setting a new industry benchmark for bioindustrial applications,’ she says. ‘We consistently see results with clients reducing production costs upwards of 50% compared to fed-batch production. In terms of environmental impact, techno-economic analysis shows that hyper-fermentation uses less power and utilities with smaller facility footprint compared to fed-batch plants.’

On the materials side, US-based Algenesis, a spin-out from the University of California, San Diego, has developed a biobased polyurethane material, Soleic, that is derived from microalgae. Importantly, it takes advantage of bioprocessing at end-of-life, too – it is biodegradable, avoiding landfill and ocean pollution, and is already made on a tonne scale.

A pair of shoes should stay around for two or three years. But they shouldn’t stay around for 200 or 300 years

Thermoplastic polyurethane (TPU) is used in products ranging from shoes to cars, but also one of the biggest generators of microplastics, says Stephen Mayfield, the company’s co-founder and chief executive. This could be avoided if they were made to be biodegradable. Could it be used to make biodegradable shoes? After a lot of development work on the material – including proving that all-important biodegradability – proof-of-concept shoes are now commercially available under the BlueView brand.

‘If they end up in the ocean or landfill, they will biodegrade in less than two years,’ he says. ‘We have some grades of material that biodegrade so fast we can’t make shoes out of them! Flip-flops get worn out in six months, so if they biodegrade in a year, great. A pair of shoes should stay around for two or three years. But they shouldn’t stay around for 200 or 300 years.’

Algae oils are first deconstructed back to C4 to C18 diacids and then built back up into the polyester polyols required to make polyurethane. Diisocyanates, the other monomer in polyurethane, are not yet available in biobased form, leaving Soleic TPU 70-75% biobased. But Algenesis has developed a way to make biobased diisocyanates that is now being scaled up, with a grant from the US Department of Energy.

Soleic is now produced at tonne scale with petroleum-based diisocyanate, and Mayfield hopes this will be swapped for the new biobased alternative in the next couple of years. ‘We’re actually at a scale now where we’re starting to talk to contract manufacturing groups,’ he says. ‘This year, I think we’ll make about 25 or 30 tonnes, and hopefully next year it will jump up to a couple of hundred tonnes as we scale up.’ And, importantly, it will be biodegradable.

More broadly, BASF’s Wilke believes biotechnology has great potential in supporting the green transformation of the chemical industry. ‘We are expecting a further expansion of biotechnology in higher value products like fatty acids,’ she says. ‘The experience and technological advances that come along with the expansion of biotech manufacturing will help to mature the technology and gradually expand into lower value higher volume products.’

Environmental policy is also critical, she says. ‘The price for carbon emissions has a huge impact on the attractiveness of biotech manufacture relative to classical petrochemical processes. A general limitation of biotech manufacturing in large volume chemical intermediates is the high capital expenditures needed to build new value chains. In other words, it would be a great advantage if the biotech intermediates could feed into existing chemical value chains.’

Additional information

No comments yet