Efforts to defossilise the chemicals industry are likely to rely on biomass, plastic waste and carbon dioxide to source the raw material needed to produce the essential everyday chemicals demanded by modern society. That’s the conclusion of a new report published by the UK’s national scientific academy, the Royal Society, which has outlined the major challenges facing the sector as it looks to transition away from fossil-based feedstocks. The report aims to inform policymakers of the potential future options for reducing the sector’s environmental footprint.

Reducing industry’s reliance on fossil-derived feedstocks is essential as the world attempts to limit the effects of anthropogenic climate change. Around 6% of the planet’s carbon emissions are linked to the chemical industry. A large proportion of these are direct emissions released by burning fossil fuels to provide the huge amounts of energy that the sector relies on. And at least a third of the industry’s emissions are linked to the fact that it sources almost 90% of its raw materials from oil, natural gas and coal.

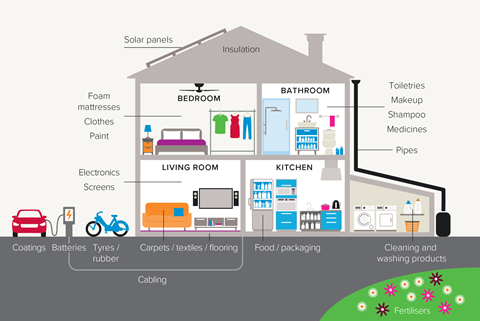

But as society is so reliant on the products that the chemical industry produces – which go into everything from fuels and building materials to consumer goods and pharmaceuticals – there is no simple way to slash these emissions. Instead, scientists writing in the new report note that the sector will need to completely overhaul its processes and find ways to use different feedstocks to make the chemicals that we all rely on.

Industry must change direction

‘For this industry to fully meet sustainability commitments it has to both electrify and move away from those fossil raw materials – this needs to happen globally,’ says inorganic chemist Charlotte Williams from the University of Oxford, UK, who was a member of the working group that produced the report.

‘Rather than having oil and natural gas that are the main drivers that we have at the moment, there will be a range of materials,’ adds Cardiff University’s Graham Hutchings, who chaired the working group.

This range of materials is likely to include biomass, waste plastic and carbon dioxide captured from industry, as well as taken directly from the air. But all of these options bring their own complications.

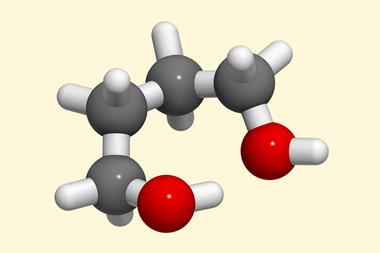

‘There are technical challenges associated with breaking down the natural components of biomass – the deconstruction chemistries of natural large macromolecules like lignin and cellulose and some of the other carbohydrates,’ explains Williams. She notes that these complex molecules need to be efficiently broken down into basic chemicals that industry can work with. While some of those chemicals might be the same as those that are used by the sector today, biomass could also offer new routes to more oxygenated raw materials. These could be harder to integrate into current processes but would benefit from retaining some of the existing chemical complexity that exists in biomolecules. Another consideration with using biomass to source chemical feedstocks is the impact that this has on land use and the balance that needs to be struck with food production and protecting nature.

Like biomass, plastics also pose difficulties in terms of the chemistry required to break the materials down into simpler compounds that can be reused. ‘There are many technical challenges in doing that and they depend on the chemistry of the polymer. Particularly for hydrocarbon polymers – polyethenes, polypropylenes – rather a large energy input is typically required,’ says Williams. ‘So there are some options there to think about different chemistries that might allow you to handle that deconstruction chemistry again – it’s a different type of raw material to biomass but a similar technical challenge.’

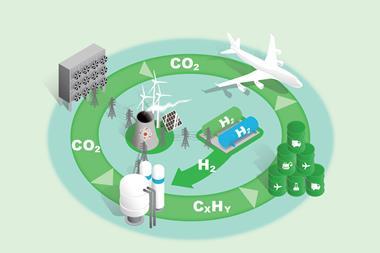

Using carbon dioxide captured from industrial processes or directly from the air also brings challenges in terms of the resources required to convert it into useful materials. ‘Thinking about ways to do reductive chemistry on the CO2 is a very active area and is a very important technological challenge, but typically involves energy and hydrogen demand – and they’re needed in other sectors, as well as the chemical industry, so there’s a balance there,’ notes Williams.

Competition for resources

In an effort to begin addressing some of the technical challenges facing the chemical industry, Williams is leading a new UK-based sustainable chemicals and materials manufacturing hub known as Schema, which has just launched. The hub will bring together researchers from the UK and international research institutions, as well as 25 companies working across industry supply chains. ‘We particularly focus in Schema in taking raw materials, exactly the types we outlined [in the report], with renewable power, through to polymers – so going all the way to end products,’ she notes. ‘And we’re working with end users in a number of sectors where they have a common materials science problem or need.’

Beyond the technical challenges associated with using new feedstocks, the report’s authors note that ‘a vast expansion of renewable energy and green hydrogen’ will be required if the chemical industry is to achieve net zero emissions. Competition for these resources, as well as the feedstocks themselves, is likely to pose a significant challenge as the industry attempts to defossilise. The report notes that ‘long-term, cross-government, international policy coordination’ could help to smooth the transition towards a net zero chemical industry, and warns that ‘without intervention, the transition to alternative feedstocks will happen over many decades’.

Cost will be another important factor. This week, chemists writing in the journal Nature provided a detailed analysis of what is required to decarbonise a single crude-oil refinery, estimating the cost at between €14–23 billion (£12–20 billion). The total cost of replacing the world’s 615 refineries by 2050 would require investments of €320–520 billion every year for the next quarter of a century.

According to Hutchings, the costs involved mean defossilising the chemicals industry will be a gradual process, starting with the production of high-value chemicals. ‘What will happen, I think, is there will be a natural growth of these processes and it will start with the high-value materials – fragrances and surfactants and things like this where small companies will start to use these resources,’ he says. ‘In my mind it will be speciality chemicals [first] and then it will finally get to the commodity chemicals because things will be price-driven at the end of the day.’

No comments yet