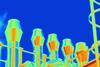

Electrification of process heat stands to slash industry’s emissions

Technologies available now can decarbonise most heat demand, but cost and infrastructure barriers still exist

Finding alternative ways to generate industrial process heat is essential as the world attempts to cut emissions and limit the worst effects of climate change. While hydrogen is often touted as a sustainable replacement for fossil fuels, in many cases, the simplest approach could be to use technologies that convert electricity directly into process heat.