Announcing the 2028 launch of its first hydrogen-powered fuel-cell electric car (FCEV) – the iX5 Hydrogen – last year, BMW described hydrogen cars as the ‘missing piece’ in the sustainable mobility jigsaw. And it’s easy to understand the excitement. On paper fuel cell cars have all the environmental benefits of battery electric vehicles (BEVs) with the added perk that they can be fuelled in three to four minutes.

But while BMW and several other car manufacturers remain optimistic that hydrogen will be the next big thing for greener motoring, others think that the race has already been run.

‘Ten years ago, it was a reasonable question to ask would the future of decarbonised road transport involve hydrogen?’ says Frank Hodgson, a senior energy analyst at Regen, who provides independent energy systems expertise to assist the UK’s journey to net zero. ‘[But] we’ve proven since then that the powertrain of the future is battery electric,’ he adds. ‘We aren’t seeing sales of hydrogen cars at all.’

A lot of the hydrogen produced today is from fossil fuels – potentially negating the environmental benefits of fuel cell cars – and the current infrastructure for refuelling hydrogen cars still leaves a lot to be desired. ‘If the industry that builds the cars isn’t behind [infrastructure] development, it’s just not going anywhere,’ says Robert Steinberger-Wilckens, an expert in fuel cells and hydrogen at the University of Birmingham.

How do hydrogen cars compare with battery electric cars?

A hydrogen FCEV is electrically driven, like a BEV and even has an identical electric motor. The main difference is the energy storage system. These cars have hydrogen stored in high-pressure tanks that is converted into electricity to power the vehicle by way of fuel cells. In some hydrogen cars, there is also a small battery containing energy to help the car accelerate quickly and recuperate energy when braking.

‘Inside the fuel cell, hydrogen from the tanks reacts with oxygen from the atmosphere to produce electricity to power the motor,’ explains Michael Rath, vice president of hydrogen vehicles at BMW.

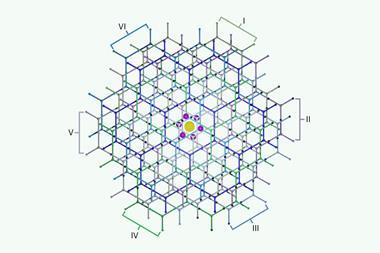

The fuel cell in a hydrogen car is an electrochemical device consisting of an electrolyte membrane sandwiched between an anode and a cathode. Flow plates channel hydrogen to the anode where the electrons and protons are separated by a catalyst, usually platinum. The electrolyte membrane allows the protons to pass through to the cathode, leaving the electrons behind, giving the anode a negative charge. The voltage difference between the two terminals causes the electrons to flow through an external circuit to power the electric motor.

At the cathode, the electrons and protons combine with oxygen from the air in a chemical reaction that produces water in the form of steam or vapour; the only byproduct of the process.

The amount of power produced by a fuel cell depends on a range of factors such as fuel cell type and size but hydrogen cars will usually have more than one fuel cell stacked together in order to provide sufficient energy to power the car.

The reaction between hydrogen and oxygen produces heat, as well as electricity, which, Steinberger-Wilckens says, gives hydrogen cars an advantage over BEVs. Owners of BEVs will know that battery performance is significantly reduced in cold weather, but hydrogen technology has been found to perform just as well as a conventional combustion engine in extreme sub-zero temperatures.

It has also been highlighted that, as the lightest of all the energy carriers, hydrogen would be a better option for lorries with large loads travelling long distances. Although, when you factor in the storage vessel, fuel cell and vehicle, the difference in weight between a BEV and a FCEV is likely negligible.

However, the most significant advantage being flagged by manufacturers is the refuelling time. BEVs can take anywhere from 30 minutes to more than 12 hours to charge depending on the size of the battery and the charging point. However, with hydrogen cars the refuelling process is much like that of a standard petrol or diesel car and the whole thing takes less than five minutes. In addition, two tanks holding a total of 6kg hydrogen could provide a range of 310 miles which means hydrogen could be a better option for long-distance driving.

There are currently two hydrogen cars available to buy in the UK – the Toyota Mirai, which has been around for 10 years, and the Hyundai Nexo, which has been available since 2019. Both cars are only available by special order – with prices starting at around £60,000 – and waits of several months to receive your car.

At the release of the Mirai in 2014, Toyota was adamant its hydrogen vehicle would mark a ‘turning point’ for the automotive industry but, 10 years on, and after selling just 27,500 hydrogen cars, the chief technology officer at the company, Hiroki Nakajima, said he was no longer sure that hydrogen had a bright future. But Toyota is not planning to abandon it just yet. The Japanese giant still believes hydrogen will have a key role to play in decarbonising transport going forward and appears to be pivoting towards hydrogen-fuelled lorries, buses and vans.

Several other manufacturers are experimenting with hydrogen including BMW, Honda, Mercedes-Benz, Renault, Stellantis and Riversimple, so there could soon be some more affordable options available. However, figures show that sales of hydrogen vehicles are dwindling and much of this is to do with the downsides of using hydrogen as a fuel carrier.

The hurdles of hydrogen

Hydrogen may be the most abundant element in the universe but producing it on Earth is still tricky from an environmental point of view. Currently, most hydrogen is made from fossil fuels, mainly by steam reformation of methane or coal gasification, both of which release carbon dioxide. If combined with carbon capture utilisation and storage, hydrogen made this way is referred to as blue hydrogen.

In contrast, green hydrogen – the only type produced in a climate-neutral way – is made using renewable energy, such as solar or wind power, to split water. However, it’ll be some time before this becomes cost-competitive with fossil-fuel hydrogen.

‘If you use any type of fossil fuel to produce hydrogen and then put it into a hydrogen vehicle, you’ll be producing more carbon dioxide than if you use the diesel or petrol vehicle,’ says Steinberger-Wilckens. ‘The one thing you don’t produce is all the NOx, the volatile hydrocarbons, the particulate matter you get from an engine, but in the way of climate change, you’re not making a difference.’

Some governments, such as the UK’s, are investing heavily in carbon capture utilisation and storage and setting ambitious targets for green hydrogen production. However, Rath admits that the widespread use of hydrogen in passenger cars will depend on the future availability of green hydrogen.

‘Hydrogen is an efficient option for storing and transporting renewable energy and will therefore play an important role in the energy transition,’ he says. ‘This applies, in particular, to countries and regions whose geography means they are unable to meet all their energy needs with renewable energies.’

But Hodgson disagrees, in fact he says one of the primary, and most talked about, reasons for hydrogen cars not taking off is that they are less efficient than BEVs. ‘Firstly, you need to make the hydrogen – that’s inherently an inefficient process, whichever way you do it … you’re losing energy on the way, and that adds cost,’ he explains. ‘Then, in the vehicle, you’ve got losses as well. A fuel cell is about 60% efficient at turning the hydrogen in the tank into power to use at the wheels – the theoretical maximum efficiency is 83% and no engineering is going to improve this. The laws of thermodynamics mean it’s always going to be a relatively inefficient powertrain.’

He also points out that we are still a long way from having cheap, low-carbon (green or blue) hydrogen. ‘This idea that in the future we’re going to have super low-cost hydrogen that we’re all going to be able to use is just not bearing fruit.’

However, efficiency alone is not enough to explain the lack of demand for hydrogen cars, he says. Ultimately, it comes down to the fact there is very limited refuelling infrastructure. ‘The selling point is it’s got a 400-mile range, [but] that’s a bit pointless if you can’t refuel it.’

Investing in infrastructure

Currently, there are just a handful of hydrogen refuelling stations across the UK and many others have been closed because of low demand.

Hodgson explains that there were hydrogen vehicle developers who realised this and focused on markets where that wasn’t as much of a barrier – for example, for buses or recycling lorries where they’re doing a known route with a hydrogen refueller at the base – with the idea that cars would come along later, ‘but that didn’t happen because of the inefficiency and higher running costs than battery–electric powertrains’, he adds.

Steinberger-Wilckens likens the situation to that of mobile phones in the 1970s. ‘Motorola … spent five years building up the networks … [before] they started selling the phones. You have to do exactly the same for the hydrogen car … if you are the manufacturer, you have to see to it that the infrastructure is built.’

He explains that big companies like Shell originally bought into the idea of hydrogen cars but are now seeing five or even 10 years of investment lying there with little or no use so are making the decision to close filling stations. He says it is down to governments to ensure that the infrastructure is built and people are incentivised to buy more environmentally-friendly vehicles. ‘If you slap the environmental and health service impact of the petrol vehicle onto the price … driving a hydrogen car would be half the cost of driving a petrol car. Unless that is resolved, we’re essentially going nowhere.’

With aggressive targets set to boost the uptake of zero emission vehicles – at the start of 2024 the UK set new laws mandating that, by 2035, all new cars and vans sold must be zero emission – vehicle manufacturers are now under pressure to sell electric cars. This, partnered with green hydrogen targets, could provide the perfect excuse for FCEVs to take on the future of climate-neutral driving.

‘For people who travel a lot by car and need a high degree of flexibility, an FCEV may be the right solution,’ says Rath. ‘In addition, there are regions and cities where it will be difficult to provide electric charging stations for all BEVs – in these locations, hydrogen drive systems can help to diversify infrastructure.’

But Hodgson is not convinced. ‘One of the things that I do at Regen is supporting electricity network companies like National Grid to forecast the future demand for [electric vehicle] charging at a geographic level,’ he says. ‘It turns out there’s quite a lot of spare capacity in the local networks; the electricity networks are all now embarking on major upgrade plans so that the capacity is there before it’s needed.’

He admits that there was a point where he was convinced of the promise of hydrogen cars over battery ones, while carrying out research on hydrogen electric powertrains at electric vehicle start-up Riversimple but says batteries have improved so much since then that this is no longer the case.

‘That’s part of it, people are not seeing the trajectory of batteries in terms of falling costs, but also improving energy density,’ he explains. ’And whilst battery production always gets a lot of attention, manufacturers have been very effective in switching to chemistries such as LFP [lithium iron phosphate] which are cheaper and lower impact.’

‘What’s confusing is BMW are quite good at battery vehicles so I don’t know why they feel that they need to continue pushing hydrogen cars … it’s just not happening.’

2 readers' comments