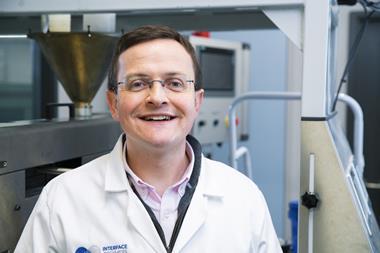

Norman Keane thinks ICI’s breakup has left a gap in scale-up knowhow and skills, as well as a lack of facilites

Nearly 30 years on from the gradual breakup and eventual sale of Imperial Chemical Industries there is still an ICI-shaped hole in the UK chemical industry, says Norman Keane, a consultant in bioplastics and renewable chemistry and technical director of the Bio-Based and Biodegradable Industries Association (BBIA).

In 1988, following a PhD in chemical reaction dynamics, Keane decided to go into industry joining ICI at the Wilton Materials Research Centre, part of the advanced materials business. ICI was once a dominant force in the UK chemical industry. Formed in the 1920s, its constituent companies produced a vast array of chemicals, from paints to explosives, and scientists working there were responsible for inventing polythene and Perspex, creating the foundations of the plastics industry.

‘In those days, we still had quite a number of world-scale chemical businesses that were recruiting lots of graduates and postgraduates and chemical engineers and so on; that was the bedrock of the industry,’ says Keane. A huge benefit of ICI was that cohorts of young graduates and postgraduates would all join at the same time, many of whom are still in contact today. ‘We’ve all gone through the industry together. We’re all getting into our 60s now, but we’re still around and we’re still active in the industry. There aren’t the big companies recruiting people in such numbers anymore,’ he says.

The scale-up facilities we have are often too expensive and insufficiently agile for SMEs to access

Keane says that one of the things he hears from a lot of companies currently is that the UK industry is now very much dominated by small and medium-sized companies, which are trying to innovate, but often lack resources. ‘Many of them are being founded by people who have finished a PhD, and rather than going to work for a big company, like I did, they’re starting their own companies. But then they’re struggling to get traction, they’re struggling to get funding. They can demonstrate work in a laboratory, but moving to the next stage – where you need to make hundreds of kilos or tons of materials – they’re finding that difficult.

‘There’s a lack of scale up facilities. There’s a shortage of toll manufacturing, because the chemical industry to support those facilities full time just doesn’t seem to be there. The scale-up facilities we have are often too expensive and insufficiently agile for SMEs to access.’ As a result, many companies are looking abroad, with India being particularly popular, because companies there are looking to expand from a strong base in pharmaceutical products into other speciality chemicals and bio-based products.

The UK, Keane says, is missing the influence of major companies underpinning the chemical industry. ‘With ICI [there] was a willingness to invest in new technologies and the strength to put metal in the ground and build facilities and scale them up; it was good at nurturing these new technologies, scaling them up, building pilot facilities, and then getting them into production,’ he says. ‘Most companies I talk to who are trying to move from the lab to pilot production, they say there’s a lack of facilities; but there’s also a lack of know-how, process engineering and experienced people that can help them.’

It’s a big industry, it’s a large exporter, but it doesn’t have a singular voice that the government seems to listen to and understand

There’s been much talk in the past year about the need for the government to implement a chemical industry strategy to feed into the broader industrial strategy. ‘Previous attempts seem to have missed the chemical industry altogether,’ he says ‘It’s a real problem. The new government has established the Chemicals Innovation Forum to address this issue.’ The chemical industry employs over 180,000 people, he notes. ‘It’s a big industry, it’s a large exporter, but it doesn’t have a singular voice that the government seems to listen to and understand. That may also be a legacy of losing ICI. The industry is beginning to come together through alliances and networks to send a clear message to government that the chemical industry is too valuable to neglect.’

He says he was recently asked about the hole left by ICI at an Innovate UK event in London and gave the example of polyethylene furanoate (PEF), a 100% recyclable, bio-based polymer produced using renewable raw materials, which was pioneered by Dutch company Avantium.

‘They seem to be gaining commercial traction, [but] it’s taken them over 10, maybe 15 years. That’s the sort of development that ICI would have looked at, because they already had PET [polyethylene terephthalate], and if they were looking for a bio-based alternative to PET, they probably would have looked at PEF and would have started investing and developing that technology.’

Keane warns that the UK is starting to miss out on some of these new developments, as the industry transforms from existing fossil-based chemicals to the bio-based chemicals of the future. ‘There is a danger that, if we’re not on the ball now, and getting the chemical industry and broader industrial strategy right, then we may miss it, and if we miss it, we’re going to rely on imports if we want to have sustainable materials.’

No comments yet