The first Covid-19 vaccine candidate went into the arms of volunteers in Seattle in March 2020. It was an mRNA vaccine from Moderna. The mRNA candidate from BioNTech and Pfizer followed in April. By December 2020, these two had become the first vaccines to be approved by the US Food and Drug Administration (FDA). Hot on their heels are rivals based on adenovirus vectors from AstraZeneca and Johnson & Johnson, as well as Sputnik V from Russia.

Early successes in developing vaccines by upstarts like Moderna and BioNTech papered over the struggles of vaccine heavyweights like Merck, GSK and Sanofi. But those companies that have surmounted the challenges of development now face the next phase: manufacturing doses on an enormous scale. And as Matt Hancock, the UK’s health secretary, told the House of Commons on 18 March ‘the process of manufacturing vaccines is complicated, and subject to unpredictability’.

Each vaccine faces production issues; the newer technologies are effectively starting from scratch. Building additional capacity is one way companies and governments are approaching the challenge. Last weekend the British government announced an additional £47.6 million to get the UK Vaccine Manufacturing and Innovation Centre being built at the Harwell Science and Innovation Campus, online even sooner. Vaccine developers are also adapting existing facilities and partnering with sometime rivals to take advantage of their manufacturing capacity and expertise.

mRNA bottlenecks

BioNTech–Pfizer’s vaccine is the first mRNA vaccine ever to be approved for people by the FDA. Large-scale production of such a vaccine has never happened before.

Moderna and BioNTech are reticent on manufacturing specifics, but in general a polymerase follows a DNA template to make the mRNA sequence by linking nucleotides together. ‘All of the enzymes are made in bacteria. The nucleotides are made chemically,’ explains immunologist Drew Weissman at the University of Pennsylvania, who contributed to the technology licensed by Moderna and BioNTech.

The entire supply chain of components and materials that go into these vaccines is new

Zoltán Kis, Imperial College London

Making the mRNA itself – which codes for the virus spike protein inside our cells – is uncomplicated. ‘The reaction mix has a well-defined composition and relatively few components, with no living cells or cell excretions or cell debris,’ says Zoltán Kis, a chemical engineer at the Future Vaccine Manufacturing Hub at Imperial College London in the UK. The mRNA synthesis takes two hours, while making the vaccine takes a couple of days.

Enzymes are added to degrade the DNA template, leaving behind an RNA molecule between 4000 and 5000 nucleotides long. This is separated out according to electrical charge or size, using tangential flow filtration or various chromatography methods. ‘The goal is to purify out the RNA to the highest possible degree, because you don’t want any impurities that could lead to side effects,’ explains Kis.

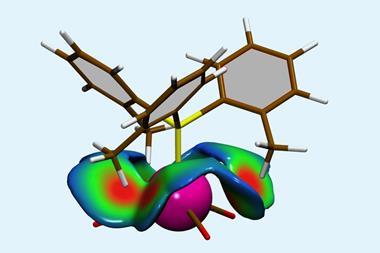

Next the mRNA is encapsulated into lipid spheres. Microfluidics must mix the mRNA and lipids in a controlled environment. ‘Here is the bottleneck, the rate limiting step in the process,’ says Kis. This view is shared by Derek Lowe, a drug discovery chemist in the US, who has written about mRNA manufacture in his blog, In the pipeline.

The two mRNA vaccines on the market use commercially available lipids but also ‘proprietary, bespoke lipids’, notes Lowe. Reports reveal ‘very exotic mixing technology’ to control the shape and composition of the lipid nanoparticles and mRNA, says Lowe. Other drug companies cannot easily chip in.

‘The manufacturing step is very unusual and tricky,’ Lowe warns. ‘The entire supply chain of components and materials that go into these vaccines is new,’ adds Kis, who notes that the supply of some specialised lipids is likely squeezed by intellectual property issues. Lipids suppliers to BioNTech include Merck and Evonik Industries, according to the Wall Street Journal, while Dermapharm in Germany, Acuitas Therapeutics in Canada and Polymun Scientific Immunbiologische Forschung in Austria are involved in the formulation process.

There are few contract manufacturing organisations with expertise and scale to contribute meaningfully to making mRNA vaccines. ‘It has to be the big players,’ says Lowe, adding that you can count these on one hand, for example Lonza and Catalent. ‘It doesn’t help if someone says they can make another 5000 vaccines. Who cares?’

Moderna says it will make 1 billion doses by the end of 2021, with 400 million doses being made at Lonza facilities in Visp in Switzerland and Portsmouth in the US. The fill and finish stage, where the vaccine is decanted into glass vials, will fall to Moderna’s partners, such as Rovi in Spain and Catalent in the US.

BioNtech–Pfizer promised at least 2 billion doses in 2021, with Pfizer sites in the US and Belgium currently making about half of those, and BioNTech making the other half. An upgrade at Pfizer’s Belgium facility paused production for two weeks early this year. Pfizer plants in Michigan, US, and Belgium took longer to set up than expected.

Rentschler in Germany and Novartis in Switzerland are supplying starter ingredients to BioNTech, as well as manufacturing some of the mRNA. ‘Not many people are familiar with these processes and have the expertise,’ says Kis. Sanofi is also set to contribute 125 million doses to the BioNTech effort, while Dermapharm is to open a second manufacturing facility in Germany in May. And the Siegfried Group is assisting with fill and finish for BioNTech.

Another bright spot is that a third mRNA company may soon enter the Covid-19 vaccine fray – CureVac. In February, the European Medicines Agency (EMA) began a rolling review of this German company’s candidate. It is currently in an efficacy trial in Europe and Latin America. This vaccine offers several advantages, says Kis: it requires 12µg of mRNA per dose, against 100µg for Moderna and 30µg for Pfizer–BioNTech. Meaning 1g will supply a lot more doses.

Adeno voodoo

The adenovirus-vector vaccines have also faced production challenges. They are newer than often assumed, with the first authorised for Ebola by the EMA only last year. Covid-19 vector vaccines rely on an impaired ‘common cold’ adenovirus to carry genetic sequences of the spike inside our cells. While RNA is made in bioreactors in a few tens of litres, virus-vector vaccines are an entirely different beast.

Production starts with a vial of mammalian cells, grown up to litre volumes, then tens and hundreds of litres, before filling 2000 litre tanks. ‘That is a common scale when you introduce the virus, which then replicates inside the cells,’ says Kis. Growing human kidney cells for the AstraZeneca process takes eight weeks. The virus takes then a few days to replicate inside these cells.

Even under the same conditions you can get different yields

Derek Lowe

AstraZeneca says it has set up manufacturing in 15 countries and 25 sites, including a licensing agreement with the Serum Institute of India (see Indian pharma companies central to vaccine output), to supply vaccine around the world. Though last week the company confirmed that production problems would reduce planned deliveries of its vaccines to the EU. The yield from a manufacturing facility in Belgium, owned by Novasep Holding, is reputedly far lower than anticipated. J&J also reportedly told the EU that it had supply issues surrounding ingredients and equipment, so might struggle to deliver promised doses to Europe by the end of June.

The viral-vector companies avoid the exotic mixing step and proprietary lipids of the mRNA vaccines, notes Lowe, but must grow huge quantities of human cells. ‘And human cell culture is voodoo. Cells do what they want,’ says Lowe. He’s heard that a J&J site in Europe has stubbornly low yields of adenovirus, which they are struggling to troubleshoot. ‘Even under the same conditions you can get different yields, so that is a weak point in using gigantic tanks of human cells,’ explains Lowe.

The cells must be fed for weeks and kept alive and dividing. ‘It never goes to plan at the start,’ says Kis. ‘Conditions don’t translate directly from small to large scale, mixing is different, pressures are different, the heat transfer is different. All this needs to be optimised at each scale. It is normal to have hiccups.’

‘Once you have enough virus, you stop the process and start purifying the virus out of a complex mixture,’ explains Kis. This mixture contains buffers, nutrients, lipids, proteins and secretions and dead cells. Virus size and surface charge can be used to purify the adenoviruses, but the process requires rigorous quality checks. Production partners must be experienced in cell-based medicines, with stringent purification capabilities. No producer wants to put adulterated vaccines on the market.

The options for governments and companies wishing to scale up are to build new facilities, which normally take several years, or retrofit or adapt existing units. Canada has a notable lack of vaccine manufacturing so the government has funded a cell-based manufacturing centre in Montréal.

‘There was no extra capacity for an unknown virus, and now companies are trying to find capacity,’ says Kis. It is somewhat easier than for mRNA production, because growing human cell culture for medicines is old hat. But expertise is crucial.

In early March, Merck announced that it would partner with J&J to manufacture its vaccine. Emergent in the US told CNBC it is making vaccines for AstraZeneca and J&J and set to churn out a billion doses annually. Moreover, the Russian wealth fund that manages Sputnik V told the Financial Times last month that it had signed contracts with 15 manufacturers in 10 countries to make 1.4 billion doses.

Existing capacity lies within facilities making recombinant protein for medicines or inactivated virus for vaccines. ‘Those could make adenovirus,’ says Kis, but ‘you don’t want to disrupt life-saving vaccines for other diseases or other injectables like cancer therapeutics.’ Also, adenovirus production requires more stringent biosafety requirements than for monoclonal antibodies, for example, notes Amine Kamen, a bioengineer at McGill University in Montréal in Canada, necessitating upgrades in facilities that make biologics.

He reckons that there would be significant resistance from manufacturers of recombinant proteins, in particular monoclonal antibodies, to introduce viruses to their production capacities. ‘It is expected that only viral vaccine producers using cell culture will accept to use their facility for adenovirus vectors,’ he adds, warning that there are not that many: Novartis, Sanofi-Pasteur, Merck and some others in India and China.

Bark up the right tree

Protein subunits is a more traditional category of vaccine, used for hepatitis B, HPV and some flu vaccines, among others. The lead candidate is from Novavax, which reported promising results in late January.

The Novavax vaccine includes a full-length Sars-CoV-2 spike protein, made by inserting a gene into a baculovirus that infects moth cells in culture. ‘These proteins then naturally assemble into spheres that approximate the virus’s size, as enabled by our protein design,’ notes Novavax. ‘This has been used industrially for a long time, so the production has been troubleshot already,’ says Lowe. ‘It is a less troublesome manufacturing route than either the mRNAs or the adenoviruses.’ Novavax says it has manufacturing sites around the world. ‘Finding production and manufacturing partners should be quite easy, because this is well established technology,’ says Kis.

However, the recombinant nanoparticles must be combined with Novavax’s proprietary adjuvant, Matrix-M, in the finished vaccine. This is crucial to generate a potent and long-lasting protective immune response, and lowers the dose of spike protein needed.

The adjuvant uses saponin from the bark of a Chilean tree, Quillaja saponaria. This is used in other vaccines, such as GSK’s blockbuster shingles vaccine, and could create supply concerns. ‘That looks like their potential weak point,’ says Lowe.

Rigorous quality checks are essential in all manufacturing approaches. ‘None of them will take risks to compromise the quality of the vaccines, because if something goes wrong, that would have huge consequences [for vaccine rollouts and public acceptance],’ says Kis. Companies are choosy about who to get into bed with, despite huge pressures to scale up.

Other challenges lie ahead. With billions of doses needed, industry watchers say even finish-and-fill capacity poses challenges. ‘As more vaccines get approved and manufacturing is scaled up, the fill-and-finish will very likely become a bottleneck as well,’ says Kis. This end stage ‘requires efficiencies in a controlled environment and has been heavily regulated,’ says Tinglong Dai, operations management expert at Johns Hopkins Carey Business School. ‘Very few manufacturers have their own fill-and-finish facilities. This has been contracted out.’

Nonetheless, companies will continue to form partnerships when business opportunities arise. Some such as the Sanofi collaboration with BioNTech and Pfizer is a little unusual. Lowe recently described this as a marriage of convenience. ‘They all have financial incentives,’ Kis concludes. ‘There are lots of profits to be made.’

Indian pharma companies central to vaccine output

Over several decades, India has developed as a major global hub for vaccine manufacturing. It supplies many parts of the world with affordable vaccines, especially the developing world. Several Indian companies are in the race to deliver Covid vaccines but their experience of manufacturing at scale has not left them immune to supply-chain bottlenecks.

The Serum Institute of India (SII) is the world’s largest vaccine manufacturer by volume. Nearly 65% of the world’s children receive at least one vaccine manufactured by SII. It is manufacturing the Oxford–AstraZeneca covid vaccine under its own brand, Covishield, and also readying itself to manufacture Novavax’s covid vaccine. It has capacity to manufacture 50 million doses per month of Covishield and is planning to scale it up to 100 million doses.

Bharat Biotech plans to produce 700 million doses of the vaccine it developed with the Indian Council of Medical Research, called Covaxin. Biological E is set to produce 600 million doses of the J&J vaccine. And Gland Pharma, Stelis Biopharma and Hetero have agree to make 252 million, 200 million and 100 million doses, respectively, of Sputnik V.

Meanwhile, the US has invoked the Defence Production Act to bolster its domestic vaccine production; SII has written to the Indian government for help as it, and others, are finding it difficult to import essential inputs – such as culture media, raw materials, single use tubing assemblies, speciality chemicals and consumables from the US.

Last year, SII chief executive Adar Poonawalla set up a new company, called Serum Institute Life Sciences (SILS), that will focus on developing, producing and supplying pandemic vaccines. It is spending $300 million building a new production plant in Pune that can make 1 billion doses a year from 2022.

Sanjay Kumar

No comments yet