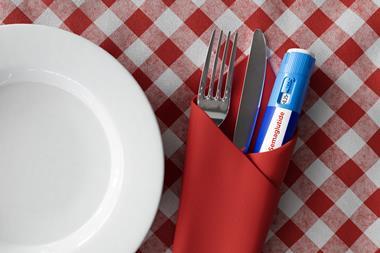

Decision ends pharmacies’ permission to prepare versions of GLP-1 hormone mimics

Novo Nordisk’s semaglutide diabetes and weight loss drugs, Ozempic and Wegovy, are no longer officially in shortage in the US, according to the US Food and Drug Administration (FDA). That means that compounding pharmacies and outsourcing facilities that had been legitimately preparing their own versions of the drugs will no longer be permitted to do so. Groups representing those suppliers have protested the decision, saying supplies are still tight.

Demand for the glucagon-like peptide 1 (GLP-1) hormone-mimicking drugs surged following Wegovy’s approval for weight loss, straining the Danish company’s ability to manufacture enough injector pens. The FDA placed Wegovy and Ozempic on its drug shortage list in March and August 2022, respectively, allowing compounding pharmacies to supply their own versions to meet demand. ‘During a shortage, compounding pharmacists can play a very important role,’ says Erin Fox, a pharmacist and adjunct professor at the University of Utah, US.

The FDA has now said that Novo Nordisk has now developed reserves of finished and semi-finished products ‘such that supply will meet or exceed projected demand’. However, some patients may encounter challenges getting prescriptions filled due to issues in the supply chain between Novo Nordisk and the firm’s customers, the agency acknowledged. The FDA is allowing 90 days for outsourcing facilities and 60 days for compounding pharmacies to stop distributing their semaglutide products.

This ramp-off was welcomed by the Alliance for Pharmacy Compounding, which criticised the lack of notice last year when the FDA ended official shortages of Eli Lilly’s tirzepatide GLP-1 products Mounjaro and Zepbound. ‘We were still seeing huge shortages of tirzepatide injections, the commercially available ones, when the FDA removed them from the shortage list,’ says Tenille Davis, chief advocacy officer at the Alliance.

She notes that there were dozens of FDA-registered manufacturers of semaglutide during the two-year period of shortage. ‘Some people wondered if compounding pharmacies exacerbated the shortage by using the semaglutide [active pharmaceutical ingredient, API], but there’s never been a shortage of the API,’ says Davis. ‘The shortage has always been on the finished dosage form – the pens that Novo Nordisk manufactures.’ Compounding pharmacies formulated the drug in vials for syringe injection, ‘just like a patient would get for insulin’, Davis explains. ‘Vials are much easier to make than auto-injector pens,’ says Fox.

It’s rare to have a brand name medicine with massive consumer demand in short supply

Compounding pharmacies are not allowed to make claims about the efficacy of their treatments, which can only be made by the originator company with FDA approval. Lilly and Novo both took legal action against entities that made marketing claims. Now that the shortages have officially ended, the drugmakers may be more inclined to take legal action to enforce their patents.

The situation with the GLP-1 drugs had been anomalous. ‘It’s actually very rare to have a brand name product with massive consumer demand to be in short supply,’ says Fox. The University of Utah Drug Information Service compiles drug shortage statistics, which are mostly low-cost, generic drugs and often sterile injectables. ‘I expect that Lilly and Novo are doing all they can to prevent a shortage from happening again.’

The profitability of GLP-1 drugs offers a huge incentive for Novo and Lilly to meet demand. In February 2024, Novo Nordisk’s parent company, Novo Holdings agreed a $16.5 billion (£13 billion) deal to buy contract manufacturer Catalent, with three manufacturing sites to be sold to Novo Nordisk to boost its manufacturing of semaglutide injectables. Both Novo and Lilly have committed to huge investments in their manufacturing capacity for these drugs, in the US and worldwide.

With compounding of semaglutide products returning to the normal confines of creating bespoke formulations for patients with specific medical needs, some patients will need to get new prescriptions for the branded drugs. Those making this switch will likely need to pay more for their medicine. ‘I think there will be access issues, but more around affordability than the product not being available,’ says Fox.

The US Outsourcing Facilities Association (OFA) – which represents compounders that specialize in producing larger quantities of compounded medicines – filed a lawsuit against the FDA for ‘a reckless and arbitrary decision’ in declaring the shortage of semaglutide over. Previously, the association had been denied a preliminary injunction to stop the FDA from removing tirzepatide from the shortage list but recently filed an appeal.

OFA chairman Lee Rosebush says the removal of tirzepatide from the shortage list came without proper federal notice, at a time when the FDA acknowledged shortages still existed. ‘The agency’s decisions [on both tirzepatide and semaglutide] will have tremendous implications across the nation for patients and physicians, as well as the outsourcing facilities that made an enormous investment to meet patient demand in light of product shortages and delays,’ he adds.

Davis says that ‘there’s been an influx of counterfeit Ozempic and a lot of illegal online sellers of research-grade peptides inappropriately labelled, but this is illegal activity not compounding.’ A study last year uncovered products being sold without a prescription by illegal online pharmacies, with unregistered and falsified products being shipped. It also noted a rise in calls to poison centres related to semaglutide.

She is concerned that legitimate compounding has been conflated with such illegal activity in media reports. ‘There’s millions of patients that rely on compounded drugs, outside of GLP-1s, and to sow doubt in an entire industry will only harm patients,’ says Davis.

1 Reader's comment